High-risk, fast-flip Solana mint backed by major partners with strong upside on launch day.

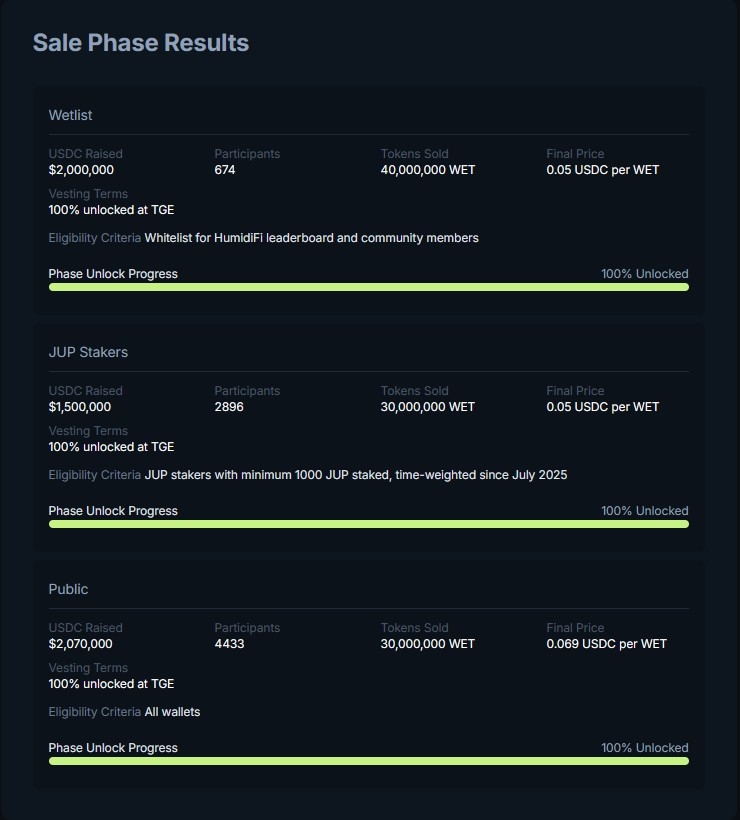

HumidiFi launched as a public DeFi token on Solana, positioning itself as an active liquidity DEX focused on improved on-chain execution. Unlike whitelist-only or private allocations, this was a fully accessible public sale, allowing anyone to participate within a capped allocation.

The token gained immediate traction post-launch, with price action driven by early liquidity inflows and short-term speculation typical of new Solana DeFi releases.

Public sale with equal access for all participants

Low initial entry price encouraged fast buy-side pressure

Hard cap limited individual exposure

Rapid price discovery post-launch

Momentum-driven move rather than long-term fundamentals

01/12/2025

HumidiFi launches via Jupiter Launchpad with a $500 USDC per-wallet cap. Entry price set at ~$0.05.

01/12/2025

(Launch Day) - Early buyers enter during the first hours post-launch as liquidity opens on Solana DEXs.

02/12/2025

Token peaks around ~$0.325 (~£0.26), delivering approximately a 6x return within 24 hours.

02/12/2025

2–3 December 2025 - Price begins to fluctuate as early participants rotate profits and liquidity normalises.

▶️ Presale / Launch Link (Jupiter)

This was a momentum-based DeFi win, not a long-term conviction hold. The strength of this flip came from speed, equal access, and disciplined exits, rather than exclusive allocation or deep fundamentals. With a low barrier to entry and fast price appreciation, HumidiFi rewarded traders who acted quickly and respected volatility.

As always with public DeFi launches, position sizing and exit timing mattered more than narrative. A solid example of how short-term Solana plays can still deliver meaningful multiples when executed cleanly.

High-risk, fast-flip Solana mint backed by major partners with strong upside on launch day.

Early farmers stacked points through DLMM liquidity farming, with estimated £300–£3,000+ in future $MET token value.